Overview

Easy PC Accounts is a user-friendly, web-based accounting package tailored specifically for small to medium Parish Councils in England and Wales. This efficient cash book system is designed to produce accounts in the Receipts and Payments format, perfect for Councils with gross income and expenditure below the statutory limit (currently £200,000 per year).

For Councils not registered for VAT, we support VAT reclaims using the VAT126 procedure.

Secure and Accessible

Your data is securely stored in the cloud, with the option to back up your files onto your own computer for added security.

Key Features

The principal record in the software is the Cash Book, which holds three types of transactions: Receipts, Payments, and Bank Transfers.

- Receipts: Money received by the Council, such as the Precept, Bank Interest, and Grants.

- Payments: Money paid out by the Council, covering all usual expenditure items.

- Bank Transfers: Internal movements of money between bank accounts.

Each Receipt or Payment is associated with a bank account and a designated Account Name, allowing for detailed analysis under specific headings. Account Names are organised into Account Groups, providing a clear structure for reports.

Customisable and Interactive

Users have full control over Account Groups and Account Names with a simple, interactive interface to set them up. A detailed tutorial and video are available to guide you through setting up your Chart of Accounts.

Easy Transaction Management

- Entering Transactions: Easily input details including Bank Account, Payment Date, Supplier, Account Name, Amount, and VAT details.

- Editing and Deleting: Modify or delete transactions if they have not been included in a bank reconciliation or VAT claim.

- Reviewing Transactions: All transactions can be reviewed via the Manage Transactions screen.

If the Council has, up to now, been using an analysed cash book either on paper or a spreadsheet, then the Account Names correspond to the columns in that cash book or spreadsheet.

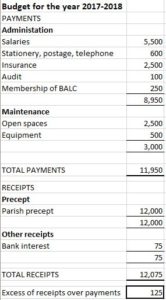

As an example, here is a budget prepared for a Council showing Account Codes and Account groups.

The Account Groups are shown in bold and provide the higher level structure of the accounts. Within each Account Group are the Account Names (or Account Codes) for the receipt or payment accounts. A sub-total is created for each Account Group and a grand total for all payments and all receipts. The overall list of Account Groups and Account Names is called the Chart of Accounts.

There is a detailed tutorial and video available showing how to set up this Chart of Accounts; you might like to look at either or both of these for more details of this part of the software.

All transactions go through a bank account (two in the case of transfers). You can set up as many bank accounts as you wish.

Example Transaction screen

For receipts and payments there is a single screen where you enter the details including Bank Account, Payment Date, Supplier, Account Name, Amount, VAT details along with Supplier (in the case of a payment) or Customer (in the case of a receipt). There is a tutorial and video illustrating this process. The following is an example screen.

Transactions can be edited or deleted, provided that they have not been included in a bank reconciliation or VAT claim. All transactions can be reviewed via the Manage Transactions screen.

Bank Reconciliation

The software includes a fully interactive process for bank reconciliation, aligning with the standard form recommended by ‘Governance and Accountability’. Detailed reports can be printed or saved for circulation to the Council. The following is an example video of this process by clicking on this link.

The output is in the standard form recommended by ‘Governance and Accountability’ and can be printed out or saved for circulation to the Council. In addition, a more detailed report can be produced as described in the documentation.

Enhanced Reporting

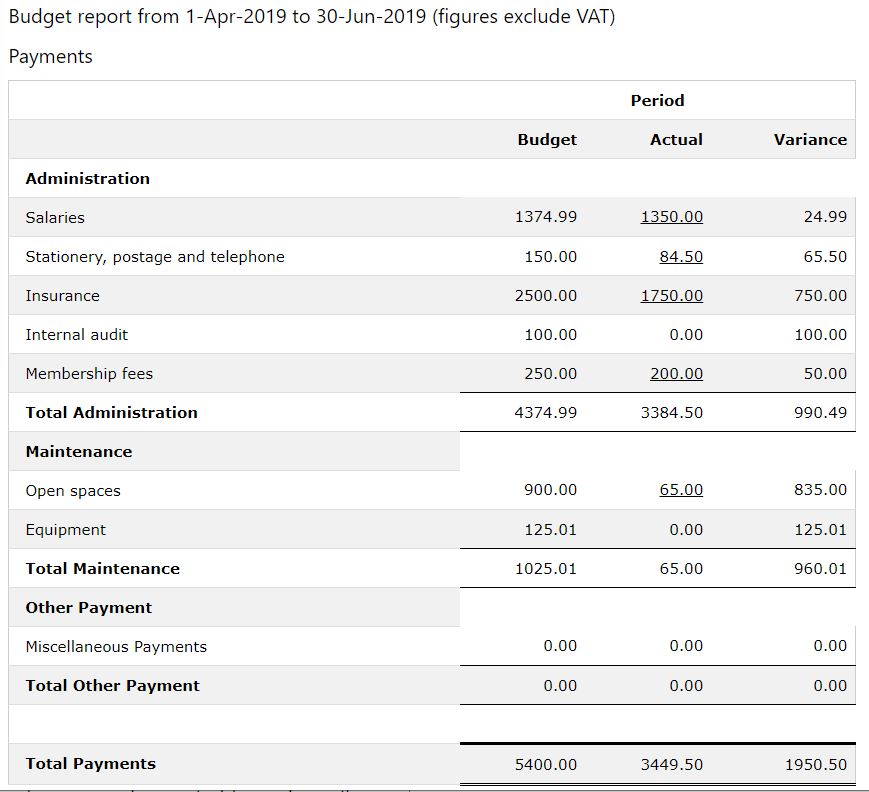

Reports such as the Budget Report show progress against budget for specific periods and year-to-date. Users can ‘drill down’ to view transactions associated with specific figures. Additionally, there’s a report offering data across selected periods with flexible presentation options.

The software provides a number of reports for the RFO and for Councillors.

It is good practice to circulate this at least quarterly to councillors, and the software allows the report to be produced including progress against budget both for a specific period and for year to date. Full documentation of this facility can be found here, but a typical report showing progress against budget for the first quarter of the 2019-2020 year is shown below (we only show the payments)

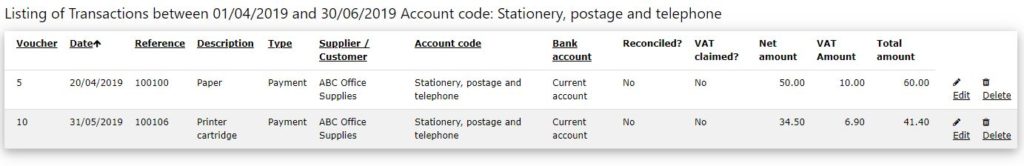

You will see that we have reported progress against profiled budgets which have been set up as described in the documentation. You will also see that some of the entries in the Actual column are underlined. This signifies that they are links which allow you to ‘drill down’ and see the transactions associated with this figure. For example, if you click on the ‘Stationery, postage and telephone’ figure you will see exactly what has been spent under that heading

This is the standard screen which corresponds to Manage Transactions so you can edit or even delete the transactions shown.

We now have a report that provides data over the quarter or month across a selected period. It does not offer the drill down option like the budget report but more options on how the data is presented.

Annual Governance and Accountability Return

The software generates figures for Section 2 of the Annual Governance and Accountability return, associating each Account Name with a specific box in the AGAR. This process is streamlined with a single click.

Managing Reserves

Easy PC Accounts also offers options to manage reserves, ensuring comprehensive financial oversight.

VAT and Reporting

Easy PC Accounts tracks VAT and facilitates claims using the special method for local councils. The software provides various reports for the RFO and Councillors, including the Budget Report, which is essential for quarterly circulation to councillors.

The base package does not support VAT100 claims. This is only relates to Councils registered for VAT (VAT – Making Tax digital). If you are interested in this option, please contact us.