Very often a firm of solicitors will require a deposit in advance before they start work on a case. At the end of the case they will issue a VAT invoice covering their fees and any disbursements. Here is a (fictitious) example of such an invoice

Tulkinghorn

Solicitors

Lincoln’s Inn Fields

| Fees relating to sale of Bleak House | £800 |

| Disbursements (not subject to VAT) | £50 |

| VAT @ 20% | £160 |

| TOTAL | £1,010 |

| Paid in advance | £500 |

| TOTAL NOW DUE | £510 |

There will be two transactions to enter into Easy PC Accounts. Firstly the deposit. This attracts no VAT and should be entered with code O (out of scope) on the date it was paid.

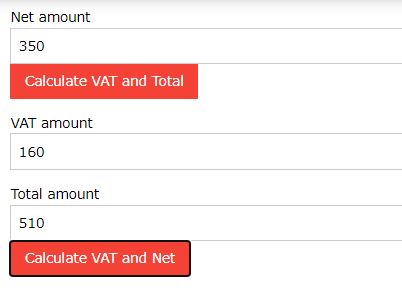

The second transaction relates to the invoice. As can be seen, VAT is chargeable on just the fees and not on the disbursements. Thus the entry into Easy PC Accounts should use the VAT code M with the total amount equal to the total now due (£510), the VAT as on the invoice (£160) and the net amount the difference (£350). Here is the relevant part of the form. Note that, although the calculation buttons are visible, they do nothing because the VAT code is M. However, the software will check that Net+VAT=Total before saving the payment.